Why Real Estate?

Diversification. More Transparency. Greater Returns.

$750K

Asset Type : Commercial Office

Capital Stack : Equity

Location : Phoenix, AZ

$750K

Asset Type : Commercial Office

Capital Stack : Equity

Location : Phoenix, AZ

$750K

Asset Type : Commercial Office

Capital Stack : Equity

Location : Phoenix, AZ

$750K

Asset Type : Commercial Office

Capital Stack : Equity

Location : Phoenix, AZ

“Crowdfunding platforms, like Case Investments Group,

are filling the gap left by the banks.”

“Case Investments Group now lets investors put

money into individual real estate markets.”

“How to buy high-end real

estate for $1,000.”

Join Thousands of Others and Invest in Real Estate

How it Works

Browse investments. You can filter by property type, returns and location

Invest in minutes through our simple and secure online process

Get 24/7 access to your investments and earnings through your secure investor dashboard

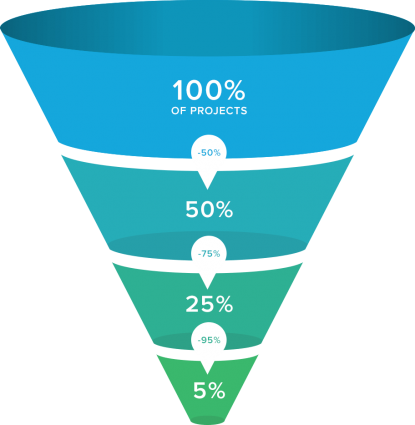

Investments Curated by our Underwriters

Only 5% of deals are approved

1. Application Submission

Companies submit application for financing

2. Prequalification

Applicants are prequalified based on track record, financial strength, and expertise

3. Project Due Diligence

Detailed underwriting includes review of investment strategy, financials, legal standing, and property condition/location

4. Project Funding

Approved projects are listed for funding on the Case Investments Group platform

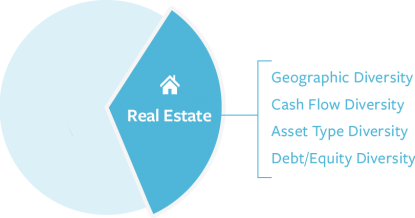

Optimize Your Portfolio

- Minimums as low as $5,000

- Choose and invest in individual properties

- Invest in residential and commercial, debt and equity

- Investor fees are maximum 2% of the invested amount

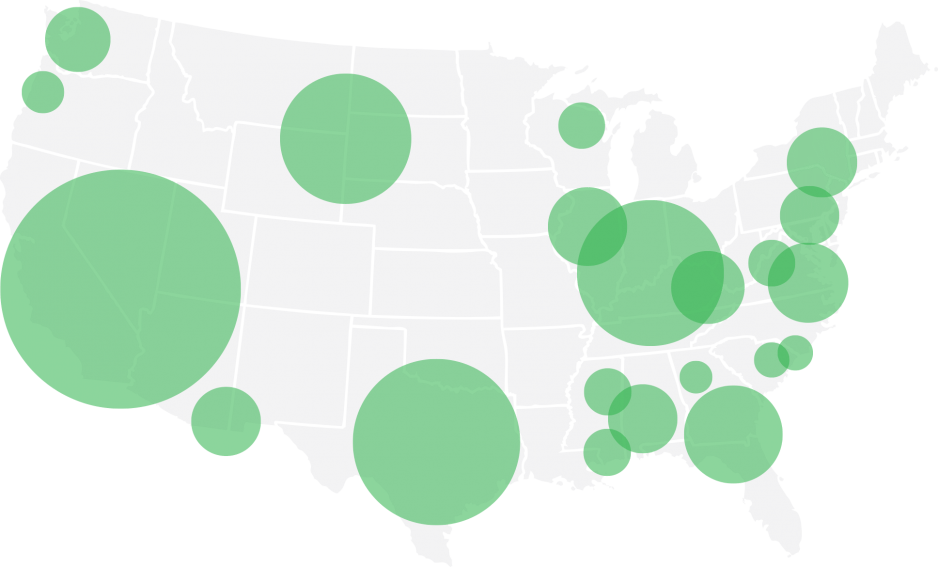

Your Portfolio

Geographically Diversified Real Estate Offerings to

Optimize Your Portfolio

Common Questions

Why should I use Case Investments Group to invest in real estate?

Commercial real estate investing in other contexts often involves large investment amounts and limited regional opportunities. Case Investments Group, on the other hand, allows accredited and institutional investors to invest for as little as $1,000, all from the convenience of an investor’s laptop or tablet computer. This means that investors have the ability to participate in opportunities that historically may have been available only to large institutions. You’ll also be investing “passively” — similar to stocks and bonds — so that you don’t need to directly be concerned with the management headaches associated with a property.

Case Investments Group does some initial review of potential investment opportunities and then, with the ones it moves forward with, presents the relevant investment information in an easy-to-use format so that investors can make their own decisions about which opportunities they want to pursue. These opportunities involve a variety of property types, are across a number of regional geographies, and can relate to debt, equity, or “preferred equity” opportunities. Once an investment has been made, investors are be able to monitor the progress of an investment via an investor “dashboard” — again, all from the convenience of your living room. These dashboards contain earnings history, management updates, and other follow-on information to be reviewed.

For additional information about investing in commercial real estate generally, see our article Why Investors Like Commercial Real Estate.

How do investors earn returns?

The frequency of any investor returns depends on the type of investment. Typically, equity investments have distributions on a quarterly basis, while debt and preferred equity investments involve payouts on a monthly schedule. An investor’s share of any distributions is generally transferred directly into the same bank account that was initially used by the investor for the contribution of the original investment amount, and typically occurs within a few days of Case Investments Group receipt of such distributions.

On debt investments, the monthly payments of interest are dependent on Case Investments Group having received the correlating payments from the borrower on the corresponding borrower loan. Preferred equity investments are designed to have “current” payments made on a monthly basis and then an “accrued” payout that is payable at the expiration of the investment period. Normal equity investments are usually designed to have investors get quarterly distributions and also to participate in any net appreciation realized when the property is sold. An investor’s share of any of these distributions will be deposited directly into the bank account designated by such investor.

Payout schedules cannot be guaranteed, of course, nor can there be any guarantee as to return rates or the return of investor capital generally, regardless of the structure of any investment opportunity.

Can I invest through my LLC, LP or Trust?

Yes, you can invest through an entity or trust. We will likely need some additional information concerning an investing entity, such as the articles of organization or the governing trust documents. Generally speaking, each owner of an entity, or each beneficiary of a trust, must themselves be an accredited investor, or else the entity must have total assets in excess of $5,000,000. Please contact us if you’d like us to get started on qualifying your investment entity or trust.

Can I invest through an IRA?

Unfortunately, even self-directed IRAs still require custodian involvement and approval before an investment can be consummated. This process creates significant delay and involves manual processes that reduce the efficiency of the Case Investments Group platform. We continue to evaluate our processes here, however, so if you are interested in investing through an IRA then please contact us and we’ll see what we can do.

If you are able to link your self-directed IRA with a bank account and can transfer funds immediately, then we may be in a better position to accept the investment; let us know and we’ll likely be able to accommodate this situation.

How do you keep my personal information secure?

We go to great lengths to ensure the security of all our members and our data and use Secure Sockets Layer. SSL is the standard security technology for establishing an encrypted link between a web server and a browser. We use 128-bit encryption, which is the same level of encryption used by top national banks. We are also regularly audited by third party security firms to ensure compliance with the most rigorous security standards.

For added protection, we never store your banking information on our servers and we automatically log you out of your account after 30 minutes of inactivity.

Do I have to pay a fee to invest?

There is no cost for registering on the Case Investments Group marketplace, and once you’ve been qualified there is no cost for browsing through the various investment opportunities on the marketplace. There is also no cost for initiating an investment — although Case Investments Group does charge a small fee during the course of the investment.

Once an equity or preferred equity investment has been made, Case Investments Group will usually charge investors an annual fee — typically 1% of the aggregate invested amount — that is paid periodically to cover ongoing investor reporting and communications relating to the investment. In addition, the funds raised will typically include a slight “over-raise” amount to cover initial legal fees related to the particular investment vehicle and other immediate transaction-specific expenses. Please review the applicable investor package and the operating agreement for the investment vehicle for details on such fees.

On debt investments, Case Investments Group typically takes a servicing fee in the form of a “spread” between the interest rate being paid by a borrower and that being paid to investors. Case Investments Group also generally charges of the borrower a loan origination fee and other charges typically associated with initiating a real estate loan. In the event of default or other special circumstances, certain fees and charges payable by a borrower will be shared among Case Investments Group and investors, as such situations involve increased servicing duties on the part of Case Investments Group. Details as to such fees and sharing arrangements can be reviewed in the applicable private placement memorandum and/or series note listing for a particular offering.